Why GanttNavigator?

Delays and Extracosts - Economic dimension of the problem - PM failures and replacements - Stock & Flow method

Delays and Extracosts - Economic dimension of the problem - PM failures and replacements - Stock & Flow method

Statistical data, but also the experiences of professionals, show that construction activity, which also represents the largest industry globally 1, shows often negative results in terms of delays and cost overruns.

A statistic carried out by the Construction Industry Institute (USA) notes that out of 975 industrial projects of various sizes, only 5.4 % of them were able to meet the budgeted schedules and costs 2. Regarding large projects (Megaprojects) in particular, the statistics confirm what is called the “Iron law of Megaprojects” i.e. nine out of ten end up late with cost overruns frequently reaching up to +50 % and in some cases even even more 3-4.

One of the main causes, if not the main cause, of these disappointing results is cited as poor time and cost forecasting 2

Gantt Navigator wants to make a contribution to understanding the underlying causes of the problem of delays and cost overruns in large infrastructure projects. To do this, using direct project management experience, Specific processes are analyzed and quantified, which are then translated into mathematical models. This analysis makes it possible to highlight the factors that limit the speed of progress in the construction process.

REFERENCES:

1 McKinsey & Company report “The next normal in construction – How disruption is reshaping the world’s largest ecosystem”; June 2020

2 PricewaterhouseCoopers LLP report – “Correcting the course of capital projects – Plan ahead to avoid time and cost overruns down the road”; Oct. 2013

3 B. Flyvbjerg – University of Oxford – “Over Budget, Over Time, Over and Over Again – Managing Major Projects”

4 B. Flyvbjerg – University of Oxford – “What You Should Know about Megaproject, and Why: An Overview” – Project Management Journal, vol 45, n.2, April-May 2014 DOI:10.1002/pmj.21409

Economic dimension of the problem

The volume of business related to Construction activity is estimated at 13 % of Global Gross Domestic Product 1 which in 2021 was about 94 Trillion Dollars [“Sole 24 ore” – May 02, 2022], a particularly low value compared to previous years because it was affected by the pandemic. However, the 13 percent figure nevertheless means a value of about 12 Trillion Dollars, which places construction as the number one industrial activity globally.

Returns from this activity after interest and taxes (EBIT) is “only” 5 percent of business volume 1 i.e. about 600 billion Dollars despite the inherent riskiness of the activity.

If through a better understanding of the processes involved in planning and controlling projects an improvement in results and a lower incidence of penalties could be achieved, even by only 0.5 % of the previous value, this would mean a greater return of 3 billion Dollars per year. A figure that would justify the effort to revise planning and control tools.

REFERENCES:

1 McKinsey & Company report “The next normal in construction – How disruption is reshaping the world’s largest ecosystem”; June 2020

Issues of failure and PM replacement

Project planning based on underestimation of the enterprise is the main cause of their failure 1 . These negative results cause significant economic damage to the firms playing the role of Main Contractor. In turn, firms try to limit the damage by offloading part of their responsibility onto their subcontractors, who, being often financially weak, go bankrupt.

This is compounded by traumatic situations ache within Main Contracting Companies, which, in order to maintain business relations with the Client, often operate internal turnover starting with the Project Manager in charge of the project. The latter are sometimes young, not particularly experienced professionals who are attracted by the relevance of the role and the mirage of a highly visible position with prospects for a brilliant career but who lack the tools to realize the riskiness of the project.

When one realizes that the project is undersized, that the contract was acquired under cost, and that the timeline is unrealistic, the first to pay the consequences as an expiratory leader is the project manager. Hence the need to better understand the reliability of the project’s target schedule.

REFERENCES:

1 PricewaterhouseCoopers LLP report – “Correcting the course of capital projects – Plan ahead to avoid time and cost overruns down the road”; Oct. 2013

References on modeling - The Stock and Flow method

The Stock and Flow method, among the models that can be used to simulate a project, seems particularly good at reproducing its dynamic nature and complexity.

Dynamic simulation models have been developed in the field of studying system dynamics. The method was used in the first half of the 1990s by Jay Forrester (MIT- Boston USA) to initially study complex business problems and then later for the study of the dynamics of growth and decline of urban centers, environmental sustainability problems, and more recently, for the analysis of the problem of climate change.

In what follows we refer specifically to modeling called Stock and Flow (S&F) 1. Applications of S&F models have covered numerous problems in the manufacturing and service sectors 2. Special attention has also been paid to construction problems 3.

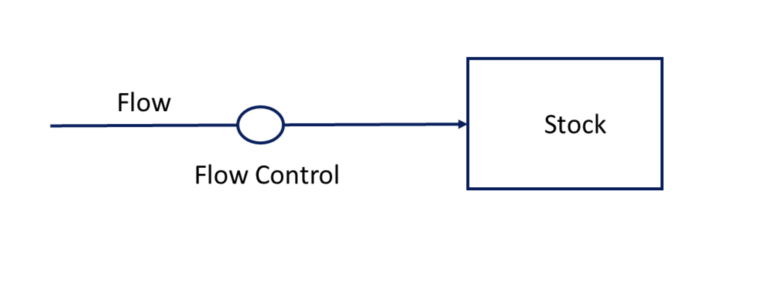

The simplest S&F model is shown in Fig. 1 in which a reservoir (stock) of a generic size (item) is depicted whose level change over time we are interested in analyzing. The reservoir is fed by a flow (flow) of that same quantity (item). In mathematical terms, the Stock thus represents the integral of the flow. I flow can be varied mediate a control element (Flow control). This modeling peculiarity succeeds in taking into account the dynamics of project-related processes.

Fig. 1 – ELEMENTARY STOCK & FLOW MODEL

Regarding complexity, this emerges when the S&F model being analyzed has more than one Stock whose “levels” influence flows of the system itself. This results in systems of differential equations whose solutions present trends that are not easily predictable and interpretable hence the term ” complex system.”

REFERENCES:

1 D.H.Meadows “Thinking in Systems” Edited by Diana Wright, Sustainability Institute, Copyright 2008

2 J.D.Sterman “Business Dynamics – System Thinking and modeling for a Complex World” Irwin McGraw-Hill Copyright 2000

3 J.M.Lyneis and D.N.Ford “System Dynamics applied to Project Management: a survey, assessment, and directions for future research”. System Dynamic Review Vol 23, No 2/3 (Summer/Fall 2007), Published on line in Wiley Interscience 157-185 (www.interscience.wiley.com) DOI:10.1002/srd.377 Copyright 2007 John Wiley&Sons, Ltd.